Why Work at Marshall Jones?

If you are looking for CPA jobs, consider choosing to nurture your success at Marshall Jones. We believe our people make us what we are. Our employees inspire us to continue growing as a company, offering accounting services to more businesses and individuals throughout the region.

Since our professional and driven employees promote our growth as a company, we do what it takes to encourage each team member’s individual growth. With us, you can find and pursue your purpose at a top local firm.

We are a fun, localized team. Though we work with big clients, we offer a community feel where each team member feels valued and supported in their career and life.

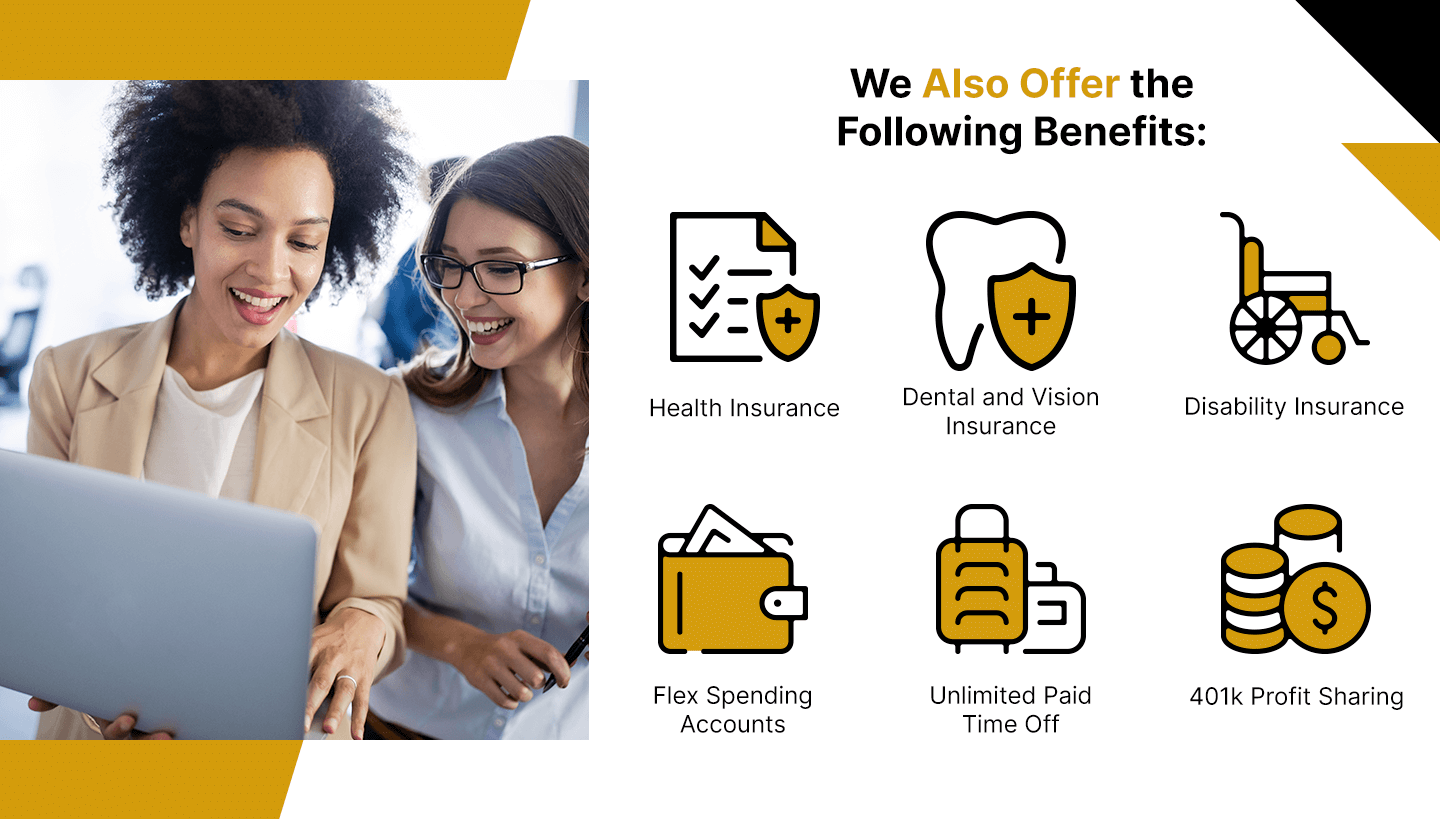

Compensation

- Competitive pay

- 401(k) profit sharing

- Health insurance

- Dental and Vision insurance

- Disability insurance

- Monetary incentives for earning a CPA license

Time Off

- Flex Life – remote and hybrid work schedules

- Unlimited PTO

- 13 paid holidays

- Paid parental leave, bereavement, and jury duty

Wellness & Perks

- Healthy snacks and breakfast foods on-site

- Annual fitness and steps challenge with cash prizes

- Optional monthly outings and events, such as attending sporting events, participating in pickleball tournaments, and more

- Life event celebrations

Our Company Values

Our core values inform our company culture. At Marshall Jones, we operate with:

Service: Everyone on our team lives to serve, whether it be their fellow employees or our clients. A mindset of humility and sincerity guides us.

Integrity: We treat our clients and employees with candor and fairness because we understand the high level of trust placed in us.

Quality: By nurturing a team culture, we promote individual success both within the company and in other areas of your life.

The Industries You'll Work With

As part of our accounting staff, you may work with various clients. Here are a few of the industries we regularly serve:

- Construction

- Nonprofit

- Real estate

- Professional services

- Small to mid-size businesses

As you grow with us, you’ll learn specialized skills that aid you in performing work for our clients. This knowledge will advance your personal success, as well.

Our accounting staff members serve various roles, from bookkeeping to payroll and financial advisory services. In these roles, your work will include reviewing financial statements, preparing documents and managing other financial information. Here are the positions we offer:

- Director of accounting

- Implementation manager

- Accounting manager

- Senior accounting associate

- Accounting associate

Our auditors ensure accurate financial records for the clients we serve. As a member of our auditing staff, you will take on tasks like gathering financial information through fieldwork, analyzing documents and preparing reports for clients. Our auditing positions include:

- Director of auditing

- Audit manager

- Audit associate

With a position in tax at Marshall Jones, you’ll handle various tax-related services for customers. The main responsibilities include preparing and filing tax returns. You will need an understanding of the federal, state and local taxation laws. Here are our available tax positions:

- Tax administrator

- Tax manager

- Senior tax associate

- Tax associate