Do You Need to Use an Accrual Method of Accounting?

As your business grows, you may need to hire more employees, acquire investors or optimize your financial planning for the future. The accrual accounting method enables you to prepare for these tax and financial changes more efficiently.

Whether you handle your accounting in-house or outsource it to professionals, it’s a good idea to clearly understand this accounting type. Our guide provides more insight into the accrual method of accounting so you can decide if it’s right for your entity.

What’s the Difference Between Cash and Accrual Accounting?

There are two primary accounting methods for nonprofit organizations and small businesses — accrual and cash accounting. Both methods are similar in that they track transactions so entities can manage their finances. However, they differ in the following ways:

Accrual vs. Cash Accounting

- Accrual accounting: Businesses that use the accrual method track income and expenses when they provide or receive a product or service. For example, a real estate company will record property management services in the books even though it will receive payment at the end of a month. If you follow the accrual method, post debited journal entries in the expense account and credited entries in the accrued expense liability account.

- Cash accounting: With this method, businesses recognize income and expenses only when they receive or pay them. In this case, the real estate company would only record the transaction for the property management services when it receives the money from the property owner.

The Internal Revenue Service (IRS) indicates that tax shelters, partnerships with a corporation, and corporations other than S-corporations must generally use the accrual method. Other business structures can use the cash accounting method but may need to transition to the accrual method as their operations become more complex.

Pros and Cons of Cash Accounting

Pros: The key advantage of the cash method is simplicity. You can simply look at your checkbook and sales receipts to add up your profits and losses. You also know exactly how much cash you have at any given time.

Cons: The downside is that when you receive or send cash may not accurately reflect when you earned or incurred an expense.

Pros and Cons of Accrual Accounting

Pros: The key advantage to the accrual method is smoothing out your profits and losses. When you make or receive a large payment for something that happened over a period of several months, accrual accounting divides the transaction over those months.

Cons: The downside to the accrual method is that it takes extra work to figure out how all your transactions should be recorded in your books. You also need to keep separate cash flow statements to know how much cash you have on-hand at any given time.

Top Benefits of Accrual Accounting

Many nonprofit organizations and start-ups choose the cash accounting method because of its simplicity. However, there are several advantages to opting for accrual accounting from the beginning. Here’s an overview of the benefits:

- More accurate snapshot of finances: Choosing this method offers you a real-time view of how much money is coming into the business. An accurate snapshot of your business finances will help investors and grant-makers make more informed decisions.

- Better insights into items sold on credit: The amount of time customers have to pay off credit varies. Adopting an accrual-based accounting method helps you keep track of sales in the month they occur.

- Improved financial forecasting: Since you record transactions as they happen, you have a better idea as to which months offer high or low turnover. These trends help you prepare for fluctuations in sales.

- Transparency ahead of financial audits: A more accurate dataset allows you to compile relevant budgets and put strategies in place for growth. Financial reports like these help you prepare for long-term success.

- Potential to defer tax payments: You are liable to pay taxes once you receive the income. If you receive money after the tax year, you will only need to make these payments in the following tax period.

When Should You Consider Using Accrual Accounting?

Keeping a consistent accounting method is important for the IRS — but which method should you choose? Here are some questions to consider if you’re contemplating the accrual method:

- Do you handle many transactions?

- Are you planning a long-term project?

- Is your main goal to improve financial strategies?

- Do you intend to apply for any grants?

- Do you have an upcoming financial audit?

If you answered yes to these questions, it may be in your best interest to adopt an accrual accounting system. Choosing this method from the start will equip you for future growth.

Steps to Transition to Accrual Accounting

Some businesses choose a cash accounting system at the start and transition to an accrual accounting method when the need and resources arise. Learn more about the steps you need to take for a seamless process.

1. Initiate a Financial Audit

A financial audit helps organizations ensure compliance and financial accuracy. Audits will also reveal any inefficiencies in your current accounting system.

If you use cash accounting yet discover obvious gaps during the audit, you will have more reason to transition to an accrual-based method.

2. Compile Relevant Documents

You will need to prepare several financial documents when you adopt the accrual system. Some of the documents you will need include:

- Balance sheets detailing your assets and liabilities

- Income statements reflecting your income and expenditures

- A breakdown of your inventory

- Cash flow statements to highlight money going in and out of the organization

- Records for accounts receivable and payable

- Any information detailing loans or other long-term debt plans

3. Update Financial Policies

Your accounting system will impact several details about your tax return, such as the transactions you include and when you submit. Update your financial policies and procedures to ensure you remain up-to-date with your compliance.

Taking this necessary step will help ensure all team members are on the same page and limit the likelihood of costly penalties.

4. Choose How You Will Manage Your Accounting

If you plan to handle your accounting yourself, you’ll need software that supports the accrual method. In addition, you will need to note these changes with the IRS by completing the relevant form.

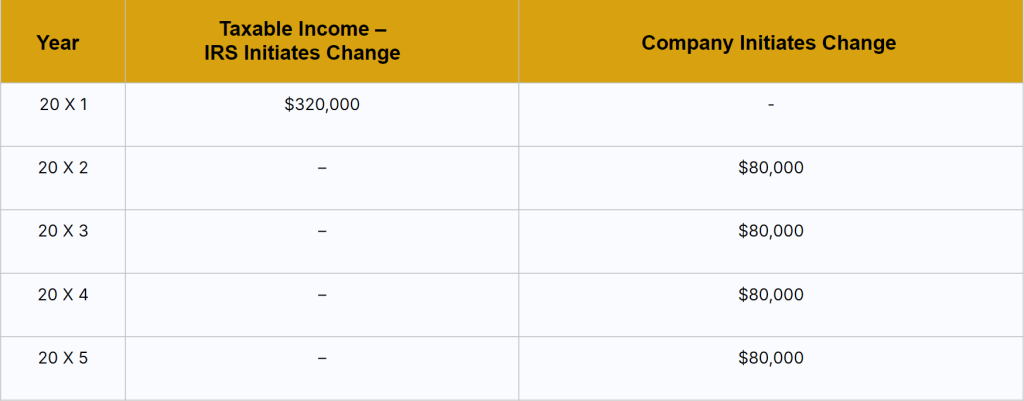

If an approved change results in an adjustment to your taxable income, you will receive credit for the difference/payment in the tax year in which the change is approved. The company can also elect to recognize one-fourth of the adjustment in the four succeeding years starting with the year of the adjustment.

For example:

Company Z, a calendar-year corporation, has a net positive section 481(a) adjustment of $320,000 at the end of year 20X1. If Company Z initiates a change in its accounting method under revenue procedure 97-27 for the 20X2 tax year, the company will recognize one-fourth of the 481(a) adjustment in the four succeeding years, start with 20X2. However, if Company Z is under examination for 20X1 and the IRS makes an accounting change adjustment, the entire section 481(a) adjustment will be taxable in the year of examination.

5. Establish a Timeline

Business transitions — especially adopting a new accounting system — are not an overnight endeavor. Create a realistic timeline detailing when you plan to integrate the accrual system formally.

Appointing relevant people to carry out these goals will ensure greater accountability while helping your organization stay on track.

Marshall Jones Makes Transitioning to the Accrual System Easy

Successful businesses and nonprofits are ever-evolving. If you started your organization with the cash accounting method and now realize it’s time to migrate to the accrual system, we can help!

Marshall Jones offers an array of accounting services, helping nonprofit organizations, construction companies and real estate businesses manage their books with ease. With our expert team at the helm, you can focus on what you do best while we track and manage your finances. Learn more about our services or get in touch with our team for more information on accrual accounting.