What Is IRS Form 8300?

While most consumer payments are made electronically, there are still times when cash is necessary or simply preferable. Since cash is harder to trace, there’s a higher chance it will be used for criminal activities than electronic payments.

That’s why the IRS requires businesses to declare any large cash payments they receive by filing Form 8300. Here’s everything you need to know about IRS Form 8300, including how and when you need to file one.

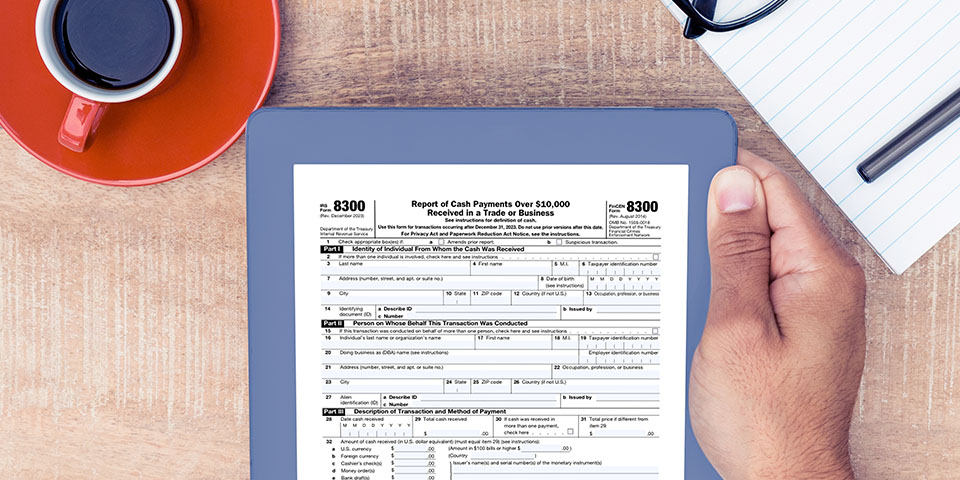

What Is Form 8300?

IRS Form 8300, also known as “Report of Cash Payments Over $10,000 in a Trade or Business,” is used by businesses to report cash payments exceeding $10,000. The main purpose of Form 8300 is to provide an audit trail to assist the government in its anti-money laundering efforts.

Qualifying cash payments can be made as single payments or multiple related transactions. For example, if a car dealer sold a car for $15,000 and the buyer paid them in monthly cash installments of $3,000, the car dealer would be required to file Form 8300.

These payments can involve coins, currency and certain monetary instruments, including traveler’s checks, cashier’s checks, bank drafts, and money orders. A monetary instrument with a face value of more than $10,000 is not considered cash.

Who Needs to File Form 8300?

When a business receives a cash transaction over $10,000, a relevant “person” must file Form 8300. This person can be an individual or a company, partnership, corporation, association, estate, or trust.

The cash payment doesn’t have to be part of a sale for Form 8300 to be necessary. You still need to file Form 8300 if you receive $10,000 or more in cash because of:

- A loan repayment.

- The rental or sale of a property.

- Expense reimbursement.

- Currency exchanges.

- Contributions to custodial trusts or escrow accounts.

Form 8300 is only necessary when any part of the cash transaction occurs within any part of the United States or its overseas territories. This covers all 50 states, the District of Columbia, American Samoa, Guam, Puerto Rico, the U.S. Virgin Islands and the Commonwealth of Northern Mariana Islands.

While cash transactions lower than $10,000 don’t require Form 8300, the IRS highly recommends filing one if businesses receive a suspicious transaction.

Filing IRS Form 8300

It’s important to file Form 8300 correctly. To do this, you should understand how your circumstances can affect the way you file the form.

How to File Form 8300

If you need to file Form 8300, you must do so within 15 days after the cash transaction occurred. Form 8300 is usually filed electronically, although it can be filed by paper under certain circumstances.

One of the most important aspects of correctly filing Form 8300 is the written statement. This statement must be given to any party you mention on the form by no later than January 31 of the year following the transaction. The statement must include:

- Your business name.

- Your business address.

- Your business contact details.

- The name of your business’s contact person.

- The aggregate amount of reportable cash.

- A declaration that you’ve given this information to the IRS through Form 8300.

Failure to deliver this written statement to all relevant parties by the deadline could result in penalties. If you’re filing Form 8300 because you believe you received a suspicious transaction, you aren’t required to provide the written statement.

Keep a copy of any Form 8300s you file for at least five years afterward.

Does Form 8300 Need to Be Filed Electronically?

In most cases, Form 8300 must be filed electronically. Specifically, if you electronically file other information returns, you must also electronically file Form 8300. Additionally, if you file 10 or more information returns in a calendar year, not including Form 8300, you must file Form 8300 electronically, too. These 10 returns can be of one or more types.

If you’re experiencing undue financial hardship, you can request an exemption from having to file electronically by filling out Form 8508. This form describes the situations where the waiver will be granted. These situations include when:

- The cost of filing electronically exceeds the cost of filing using other media.

- Access to the internet is unrealistic, particularly for rural businesses.

- The filer lacks the necessary digital literacy.

- The business has suffered due to a federally declared disaster.

- Fire, casualty or natural causes have affected the business.

- Death, serious illness or unavoidable absence of the individual who files Form 8300.

- The business is in its first year of operation.

- A foreign entity is unable to access the necessary software, or other uncontrollable issues hinder their ability to file electronically.

If the waiver is granted, it will be automatically applied to every Form 8300 you file in that calendar year. You must write the word “Waiver” at the top of each Form 8300 that you file.

If filing Form 8300 electronically would require you to use technology that isn’t compatible with your religious beliefs, you are automatically exempt from filing Form 8300 electronically. In this case, you must write “Religious Exemption” at the top of each Form 8300 that you file.

If you aren’t required to file Form 8300 electronically, you can still choose to do so.

What to Do If You’re Filing IRS Form 8300 Late

Any late filings are liable to penalization. If you file Form 8300 past the 15-day deadline, you must declare this. File the form as you normally would, and write the word “Late” at the top of each relevant Form 8300.

If you file your Form 8300 incorrectly, it can be considered a late filing. For example, if you sent your Form 8300 through the mail when you were required to file it electronically, it would be considered a late filing.

Make Filing Your Form 8300 Simple With Marshall Jones

Knowing exactly how and when to file Form 8300 isn’t always straightforward, especially when you’re focused on running your business. That’s why it can be hugely beneficial to work with a reliable tax consultant.

At Marshall Jones, our tax planning and compliance services are designed to make filing any information returns simple. We’ll help you file the relevant forms on time and correctly to support your business.

To find out more about how our knowledgeable advisors can help you file Form 8300 and assist with other tax or filing needs, contact us today.