What Are Tax Shelters? Best Tax-Sheltered Investments

Everyone wants to keep more of their hard-earned money, but determining the best ways to legally reduce your tax bill can feel overwhelming when considering the complex financial regulations.

Tax shelters provide a legitimate path to lower your tax burden. The trick is knowing which ones you qualify for and how to use them effectively. This guide will walk you through the essentials — from tax shelter examples to practical tips — so you can make informed decisions and maximize your savings.

What Is a Tax Shelter?

Tax shelters are financial strategies that reduce taxable income.

- Investments: Investments like retirement accounts offer tax-deferred growth. That means you won’t pay taxes until you withdraw the money — sometimes, when you’re in a lower tax bracket.

- Deductions: You can deduct eligible expenses when filing your taxes. Deductions include charitable donations, medical costs and mortgage interest.

- Income shifting: You can reduce your tax burden by shifting income to family members in lower tax brackets or relocating funds to jurisdictions with lower tax rates.

- Tax credits: Credits directly reduce the amount of tax you owe. For instance, you might qualify for credits based on education expenses, energy-efficient home upgrades or child care costs.

Tax Shelters vs. Tax Evasion

While there are legitimate strategies for reducing your tax burden, not all methods are legal. Some people attempt to lower their tax bills through illegal shelters, which crosses the line into tax evasion.

One tactic involves using tax havens, or foreign countries with little or no tax on trusts or financial accounts. If attempting to avoid disclosing the full scope of your wealth or hiding money from the IRS by placing assets in confidential overseas accounts sounds dishonest, that’s because it is.

Holding assets abroad isn’t illegal. But if you fail to report those assets or intentionally avoid paying taxes on them, it becomes tax evasion — which can have dire consequences.

What Are the Best Tax Shelters?

You can reduce your tax burden by using legal tax shelters — here are some of the most popular and proven options.

Retirement Accounts

Investing in retirement accounts is an excellent way to defer your taxes while saving for the future.

- IRA: Anyone earning an income can contribute to an individual retirement account, which lowers their taxable income for that year. You can defer your taxes until you retire and withdraw your assets.

- Roth IRA: Contributions to Roth IRAs aren’t tax-deductible, but qualified withdrawals are tax-free, which can result in you paying less tax in the long run.

- 401(k)s and 403(b)s: Employer-sponsored retirement accounts let you invest pre-tax dollars to reduce your taxable income. You’ll pay taxes when you withdraw the money upon retirement.

Real Estate

Depreciation deductions allow real estate investors to spread their deductions over a longer period and deduct more from their taxable income. You can also deduct mortgage interest payments and property taxes.

Additionally, you can reinvest and defer capital gains taxes from one investment property to another — a tactic known as a 1031 exchange. If you sell your primary residence, you can be eligible for a considerable capital gains tax exemption.

Municipal Bonds, Mutual Funds and Exchange Traded Funds

Municipal bonds are a way for governing bodies to fund infrastructure projects such as new roads, schools or hospitals. Through bonds, public bodies can borrow money in exchange for interest payments. These interest payments provide the tax benefits.

While it’s not always the case, municipal bond interest can be exempt from federal taxes if the issuer meets specific requirements. Tax exemptions may also be available at the state and local levels if the buyer lives in the same state that issued the bond.

If you contribute to a mutual or exchange-traded fund that invests in municipal bonds, the interest you gain from this will also be exempt from federal taxes.

Health Savings Accounts

Contributions to your health savings accounts are deductible from your taxable income, and withdrawals you make for eligible medical costs are tax-free, too. Your money can grow tax-deferred while building your medical savings account.

Business Ownership

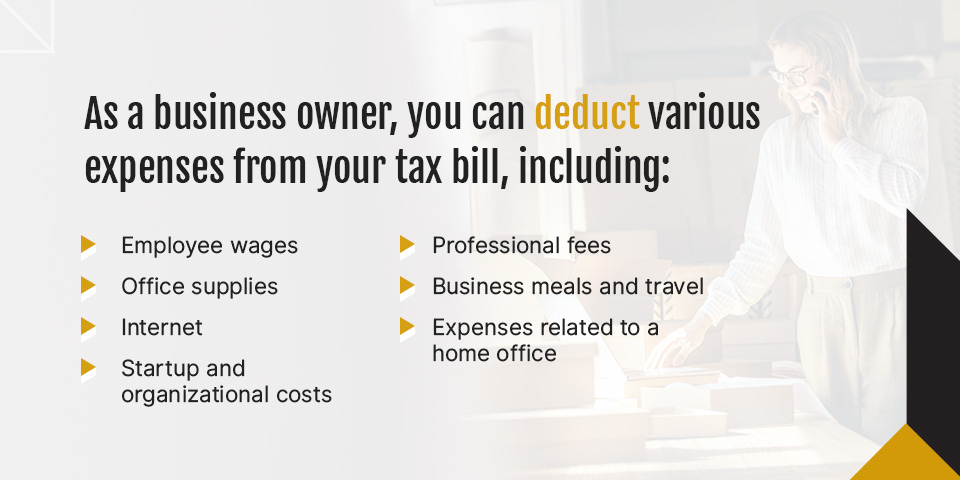

As a business owner, you can deduct various expenses from your tax bill, including:

- Employee wages

- Office supplies

- Internet

- Startup and organizational costs

- Professional fees

- Business meals and travel

- Expenses related to a home office

Consult a professional who can walk you through your options for reducing you and your business’s tax bill.

Charitable Donations

Though IRS limits apply, donating to qualified charities can lower your taxable income. You can give cash or noncash assets, like stocks or property.

Which Tax Shelter Is Best for You?

With so many legal ways to reduce your tax burden, deciding which is best for your financial situation and goals can be challenging. Here are three questions to ask yourself to narrow down your options.

1. How Much Money Can I Invest Right Now?

Whether contributing to your retirement fund or donating to charity, virtually every tax shelter requires you to spend or invest money to reduce your taxes.

However, some tax shelters, such as purchasing real estate, require higher investments than others. Others grant you more tax benefits the more you spend or invest. If you don’t have the funds, this will remove a few tax shelters as options for you.

2. How Liquid Do I Want to Be?

Rigidity is a drawback of many tax-sheltered investments. For instance, property demands a significant upfront investment and may take time to sell. Meanwhile, IRAs and other retirement accounts will penalize you for withdrawing money prematurely. If your budget’s tight, a few of these options might not be feasible.

Municipal bonds and mutual funds may be your best strategies to remain as liquid as possible while still benefiting from tax advantages.

3. What Are My Financial Goals?

Identify your long-term financial objectives aside from lowering your tax bill. Do you want to build a property portfolio? Have you always dreamed of retiring early? Let your fiscal targets guide your use of tax shelters, not vice versa.

Receive Personalized Tax Shelter Guidance

When used correctly, a tax shelter can be a powerful way to reduce your tax bill. Missteps can lead to IRS underpayment penalties and even legal consequences.

Marshall Jones helps our clients maximize the benefits of tax shelters while staying fully compliant. Our team can recommend strategies that align with your financial goals and properly document every detail.

Contact us today for personalized advice and a legal strategy that unlocks the full value of tax-saving opportunities.