How to Get a General Contractor License in Georgia

Are you interested in a challenging and rewarding career as a general contractor in Georgia? This license is highly sought-after as it authorizes unlimited residential and commercial projects, opening up a world of possibilities.

How do you get a general contractor license in GA? There are several prerequisites to applying for your license, including age, education, experience and specific financial, tax and insurance requirements.

Who Needs a Contracting License in Georgia?

Anyone offering or performing construction work costing more than $2,500, including materials and labor, must have the correct license from the State Licensing Board for Residential and General Contractors, or they will be acting illegally.

Types of Contractor Licenses in Georgia

Before learning how to obtain a general contractor license, it’s important to note that four contracting licenses are available in Georgia.

Here are Georgia’s four contractor license definitions and their specifications:

- Residential-basic contractor license: A residential-basic contractor can legally perform contractor activity or work on specific structures only. The scope of this license extends to one-family townhouses and detached one-family and two-family residences that are not more than three stories tall, as well as their accessory buildings and structures. The requirements for residential contracting licenses differ from those of general contracting licenses.

- Residential-light commercial contractor license: A residential-light commercial contractor may perform contractor activity or work on multifamily and multi-use light commercial buildings and structures that are less than four stories tall and less than 25,000 square feet of total interior space. If the building they are working on is engineered steel, it can be 50,000 square feet.

- General contractor limited tier license: Individuals with limited tier licenses are subject to the same parameters as general contractors, except they are subject to a financial limit of $1,000,000 per contract.

- General contractor license: The general contractor license allows the holder to perform unlimited construction work. General contractors may take on projects of any size, residential or commercial.

Georgia General Contractor License Requirements

Before applying for your dream career, you must understand the specifics. Here’s what you need to know about the requirements for a general contractor license in Georgia.

Age

Individuals have to be 21 years of age to apply for a general contractor license. Once you have turned 21, you can begin the application process if you meet the other necessary criteria.

Education and Experience

When submitting your application, you will be required to swear the information you’ve included is correct and submit satisfactory proof. To be considered eligible for a general contractor license in Georgia, you must have education or experience that meets one of these three options:

- Four-year degree plus a year’s experience: You must have completed an accredited four-year bachelor’s degree in college or university in either engineering, architecture, building construction, construction management or another field acceptable to the General Contractor Division. In addition, you must have at least one proven year of experience working as or employed by a contractor unless you have other background that the General Contractor Division approves as substantially similar.

- Courses and experience equal to four years: You must have a combination of academic credits from accredited college-level courses and proven practical experience equal to at least four years that the division deems acceptable.

- Four years of proven experience: You must have at least four years of experience working in construction or a similar field. Your experience must include at least two years in the employment of a general contractor or other employment found acceptable by the General Contracting Division. Finally, your experience must consist of one year in administration, marketing, engineering, accounting, estimating, drafting, project management, supervision or other division-approved activities.

Minimum Net Worth

When applying to become a general contractor, you must provide satisfactory proof that you have a net worth of at least $150,000 to be eligible.

Insurance

In the application, you must show that you have general liability insurance of at least $500,000 per occurrence. In addition, if you have employees, you must provide workers’ compensation insurance in compliance with Georgia law.

Examination

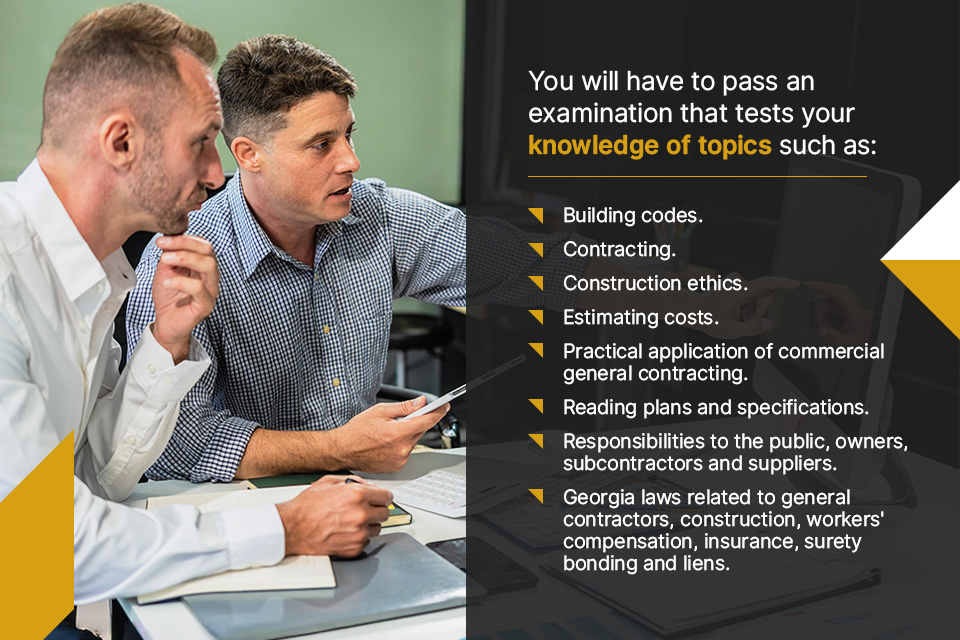

To obtain a general contractors license, you will have to pass an examination approved by the General Contractor Division that tests your knowledge of topics such as:

- Building codes.

- Contracting.

- Construction ethics.

- Estimating costs.

- Practical application of commercial general contracting.

- Reading plans and specifications.

- Responsibilities to the public, owners, subcontractors and suppliers.

- Georgia laws related to general contractors, construction, workers’ compensation, insurance, surety bonding and liens.

Other Requirements

To be considered eligible for a Georgia contractor license, you will also have to:

- Demonstrate good character: Those applying for a general contractor license must prove to the General Contractor Division that they demonstrate competency, integrity, ability and financial responsibility.

- Consent to a background check: You will have to sign a form consenting to a background check, including criminal history, and submit it with your application.

- Verify your tax payments: You must prove you have been paying your taxes for a prescribed period.

- Designate a qualifying agent (if applicable): If a business requires a contracting license, the application must be submitted by a qualifying agent who works for or owns part of the business.

- Establish a joint venture (if applicable): Should two or more individuals or businesses want to operate a joint venture, they must either apply as the joint venture itself or the two or more individuals or qualifying agents acting on behalf of a business must each have a general contracting license.

- Confirm eligibility as a military spouse or transitioning service member (if applicable): If you are considered an eligible candidate, you may qualify for expedited processing.

How to Apply for a General Contractor License in Georgia

Now that you understand the requirements, how do you get a general contractor license in GA? Firstly, it’s important to remember that when you apply for your license, you’ll need to select either the individual or the qualifying agent application. Once you have made your selection, you will proceed as follows:

- Complete the application

- Gather supporting documents

- Review and double-check

- Submit the application

If you struggle to assemble your supporting financial documents, consider seeking expert assistance from a skilled tax and accounting professional to increase the likelihood of your application’s success.

Financial Requirements for a GA General Contractor License

From demonstrating the required net worth to providing proof of insurance and tax compliance, having your financial documentation in order is essential. You’ll need to fulfill the following financial and insurance requirements to obtain a general contractor license:

- Pay a non-refundable application fee

- Demonstrate financial responsibility

- Prove your net worth with a certified public accountant (CPA) reference letter

- Verify tax payments

- Provide proof of acceptable insurance

Audit and CPA Reference Letter

Applicants for a general contractor license in Georgia must provide a CPA reference letter or form attesting to a review or an audit. While an audit for your general contractor’s license is not a strict requirement, it is advisable for your success. Having an auditor demonstrate your financial stability helps you present a strong and credible application.

Get Financial Assistance for Your General Contractor License Application

Navigating the financial requirements for a general contractor license can be complex. Marshall Jones specializes in audits for the construction industry and provides accurate and up-to-date financial analysis and information you can use for your application. General contractors and construction companies face unique accounting challenges, and we help overcome them.

Marshall Jones Certified Public Accountants And Advisors is a full-service accounting firm in Atlanta, GA, serving individuals, corporations, small businesses and nonprofits. Our experienced team provides tax preparation and compliance services, audit and assurance assistance and client accounting services. Let us help you save time and support your success.

Learn more about Marshall Jones, or contact us with any questions.