Generation-Skipping Trust (GST): An Ultimate Guide

It’s one thing to build wealth and a legacy, and it’s another thing to protect what you’ve built for future generations, for as long as possible. Sadly, estate taxes can take away more of your family’s wealth than you might expect. For this reason, it’s crucial to invest in tax-efficient estate planning because it’s the key to transferring generational wealth with minimal tax repercussions.

One such tax-efficient estate planning strategy is the generation-skipping trust (GST). While this type of trust is not entirely tax-free, it does offer some valuable tax advantages, reducing the overall tax burden on your heirs. This guide provides detailed information about GSTs and how you can use them to protect what you leave behind.

What Is a Generation-Skipping Trust?

A GST is an irrevocable, legally binding agreement that allows you to transfer assets from your estate to your grandchildren or unrelated people, rather than to your children. The designated beneficiaries must be at least 37.5 years younger than you. By bypassing your immediate children, you protect your assets from subjection to successive rounds of estate taxes that would otherwise have been due if you transferred them to the next generation.

How a GST Works

GSTs are an effective way to protect your wealth and spread your assets across multiple generations while minimizing taxation. Let’s break down how this trust works and the steps involved in creating one:

- Establish the GST: This first step involves working with an estate planning attorney and financial advisor to create the GST. The trust document should spell out the terms of the trust, the powers of the trustee, the beneficiaries and the rules governing the distribution of assets.

- Fund the trust: Next, fund the trust with assets. These can be anything from cash and stocks to real estate and other investments.

- Appoint a trustee: You must appoint a trustee to manage the trust and oversee distributions of assets in line with the terms of the trust. You can nominate an individual, a group of individuals or a corporate entity as a trustee of the GST.

- Designate beneficiaries: Beneficiaries of a GST can be your grandchildren, great-grandchildren or anyone unrelated to you, provided they are 37.5 years younger than you. You must designate beneficiaries of the trust, as well as the terms under which they can access the trust’s assets. For instance, you may specify milestones such as the beneficiary turning a specific age.

- Outline distributions: You can set terms that outline how trustees will make distributions for things like living expenses to your beneficiaries.

- Determine the duration of the trust: The duration of a trust can vary depending on state laws. While some GSTs can last for several generations in some states, other states enforce rules that cap the duration of such trusts.

- Specify grounds for termination: There are several instances in which a GST can be terminated, including when the last living beneficiary dies, when the trust assets are fully exhausted or when state law dictates otherwise.

Benefits of a Generation-Skipping Trust

Several benefits of GSTs make them stand out from other types of trusts.

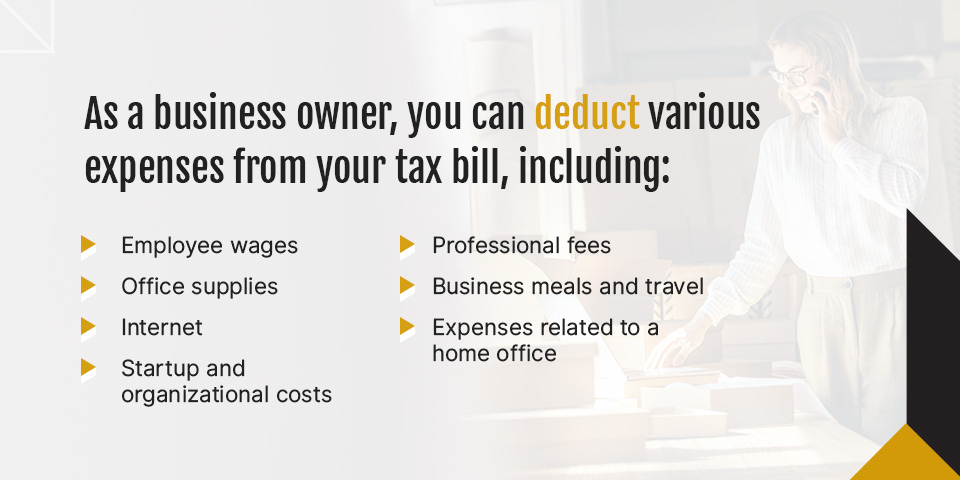

Tax Efficiency

Taxes, such as estate taxes, can significantly impact generational wealth, reducing the value of what is passed down to future generations. GSTs are designed to solve this problem by reducing or eliminating such taxes. This way, heirs can fully enjoy the wealth that has been transferred to them by grantors.

Asset Protection

Because assets in a GST are not treated as personal properties of beneficiaries, they are protected from and out of reach of creditors, court judgments and divorce proceedings. Consequently, you can rest assured that your wealth will remain in the family long after you are gone.

Control Over Assets and Wealth Distribution

GSTs give you a high level of control over how your assets are distributed among your beneficiaries. You can set the specific, long-term rules to govern the trust and outline the qualifications your beneficiaries must meet to receive assets.

Privacy

You may want to keep your family affairs private and away from public scrutiny. GSTs afford you this luxury of privacy. The terms and assets associated with this type of trust are not part of public records, so you can count on your affairs staying private and within your family.

Potential Drawbacks of a GST

Despite all the benefits GSTs offer families, you should be aware of some potential drawbacks before establishing them.

Irrevocability

GSTs are irrevocable, and once established, you can’t change the terms of the trust. This lack of flexibility can be problematic, especially since family circumstances could change over time, necessitating adjustments to the established trust terms. Additionally, tax laws can also change, leaving you advantaged or disadvantaged depending on the terms already agreed upon.

Risks of Family Conflict

A GST is designed to skip a generation in your family and focus on the generations that follow. In many cases, you can set up the trust so it still provides for your immediate children. However, GSTs may still expose your family to risks of conflict. If your children had hoped to inherit the family fortune, they may be disappointed or even resentful of your decision to skip them altogether.

Heir Preparedness

Since the beneficiaries of a GST will likely be minors, they may not have the capacity to adequately handle and manage their inheritance without proper guidance and support. While you can set milestones and conditions to govern the distribution of your assets, they can’t ensure that your heirs are prepared for the responsibilities that come with it.

When Is a GST the Right Move for You?

There are specific circumstances where a GST may be ideal for you:

- You have significant assets: If you have substantial assets you want to keep in your family for generations to come, a GST will provide you with the protection you need, both from taxes and legal liabilities. However, if your estate is small, you’re better off exploring other low-cost options.

- Your children have sufficient assets of their own: It’s easier to skip your children in a GST when they are financially secure and capable of taking care of themselves without your help. On the other hand, if they have immediate financial needs, it may be unfair to skip them and pass your wealth to your grandchildren.

- You have a healthy and closely knit family: GSTs have the potential to cause tension in families, especially those that are already strained. With healthy and more closely knit families, these tensions can be easily resolved if everyone comes to understand the benefits of a GST. If your family falls under this category, a GST is the way to go. Conversely, if your family relationships are already strained, a GST can exacerbate the damage to them.

Secure Your Legacy With Expert Guidance

Under the right circumstances and when done correctly, a GST can protect your family assets long after you leave the scene. Professional assistance is key to ensure a smooth process, which is where experienced financial advisors come in.

At Marshall Jones, we help people like you, who want to secure their legacies, navigate GSTs. Contact us to learn more about how our team of financial advisors can assist you.